Scott's declaration that Geelong hasn't undergone a rebuild for 14 years, and won't start now, reminds me of the steadfast leadership that Partner CFOs bring to organisations. Like a seasoned coach, Partner CFOs don't panic when faced with short-term setbacks. Instead, they look at the bigger picture, assess the team's strengths and weaknesses, and strategise for long-term success. Whilst they keep a close eye on what the short-term data is telling them and adjust their tactics accordingly, they maintain a strategic outlook, balancing short-term performance with the mission and the vision.

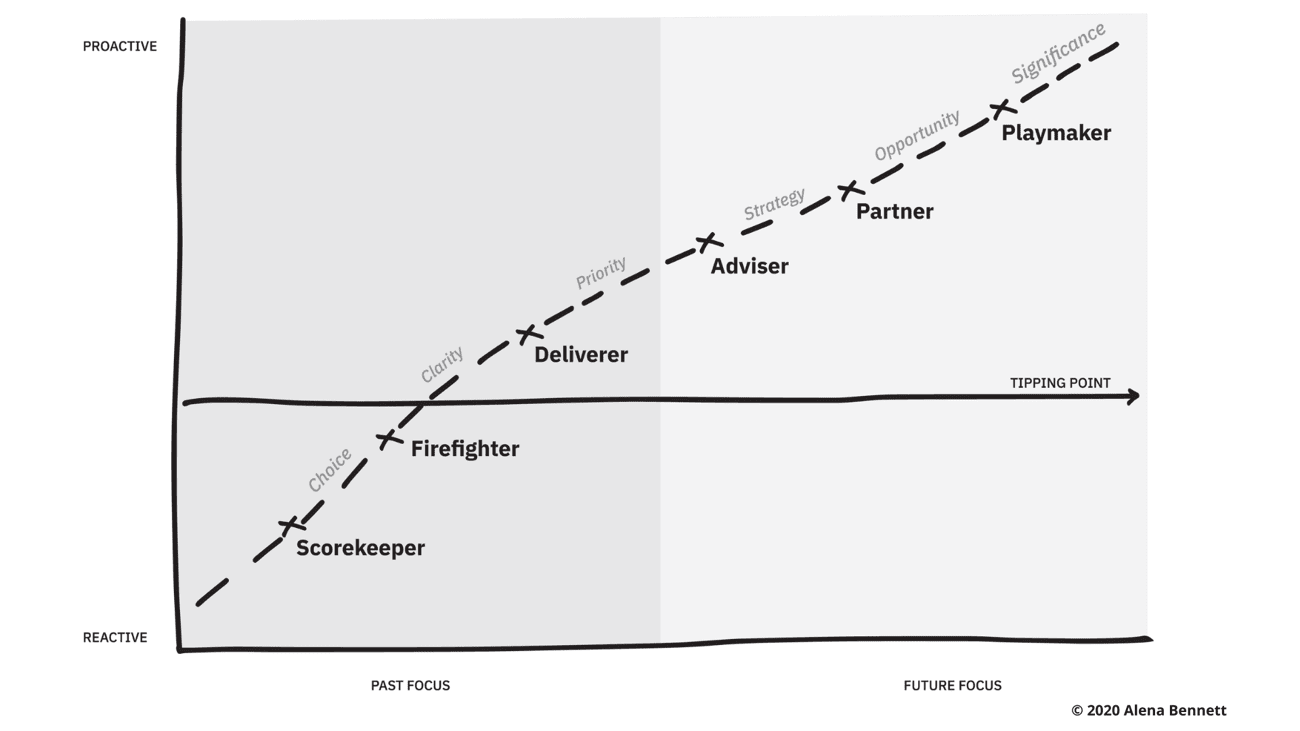

In our CFO Evolution series, we've journeyed from the reactive Firefighter, through the capable Deliverer, to the insightful Adviser. Now, let's explore what it takes to be a Partner CFO - a true co-captain and the effective CEO's secret weapon.

According to our research, Partner CFOs sit in the top third of all CFOs according to our research; or about 31.88%. This is a level where finance leaders are not just part of the strategic conversation - they're often leading it. Whilst they are not at Playmaker level yet, they're very near the top of their game and they are an enormous asset to their CEO.

⋅ They seamlessly integrate financial strategy with overall business strategy

⋅ They have strong relationships with both internal and external stakeholders, who value their viewpoint and contribution

⋅ They're seen as a trusted guide by the CEO and other C-suite executives on a wide range of business issues

⋅ They're actively developing the next generation of finance leaders within the organisation

The distinction between an Adviser and Partner, is that when you're an adviser, your stakeholders might ask for your opinion. But that's it. That's where the interaction stops. It's almost like you're an external adviser to the business. (A red flag is if you're known as the Support Office.) When you're a partner, you walk alongside each other through the highs and lows of the journey, facing the challenges and celebrating the rewards together.

Does this sound like you? If so, well done! You're a financial leader who's making a solid impact on your business.

1. Balancing Breadth and Depth: Partner CFOs need to maintain a broad perspective on the business while still ensuring the finance function runs smoothly.

2. Managing Diverse Stakeholder Expectations: From the board to investors, from the CEO to operational teams, Partner CFOs must balance various, sometimes conflicting, expectations.

3. Driving Organisational Change: Partner CFOs often lead major transformation initiatives. This can be met with resistance, and whilst the Partner CFO is influential, they are not yet seen as the 2IC to and stand-in for the CEO.

Remember, these challenges are opportunities for growth for you. Each one overcome strengthens your potential impact on the organisation.

⋅ An ability to see the 'whole field', understanding how different parts of the business interact and impact each other.

⋅ Strong leadership skills, inspiring and guiding not just the finance team, but influencing the entire organisation.

⋅ A talent for translating complex financial concepts into actionable business strategies.

⋅ Resilience and adaptability, able to adjust strategies quickly in response to changing business conditions.

Any of these sound familiar to you? These skills, when fully leveraged, can significantly enhance your organisation's performance and competitive position.

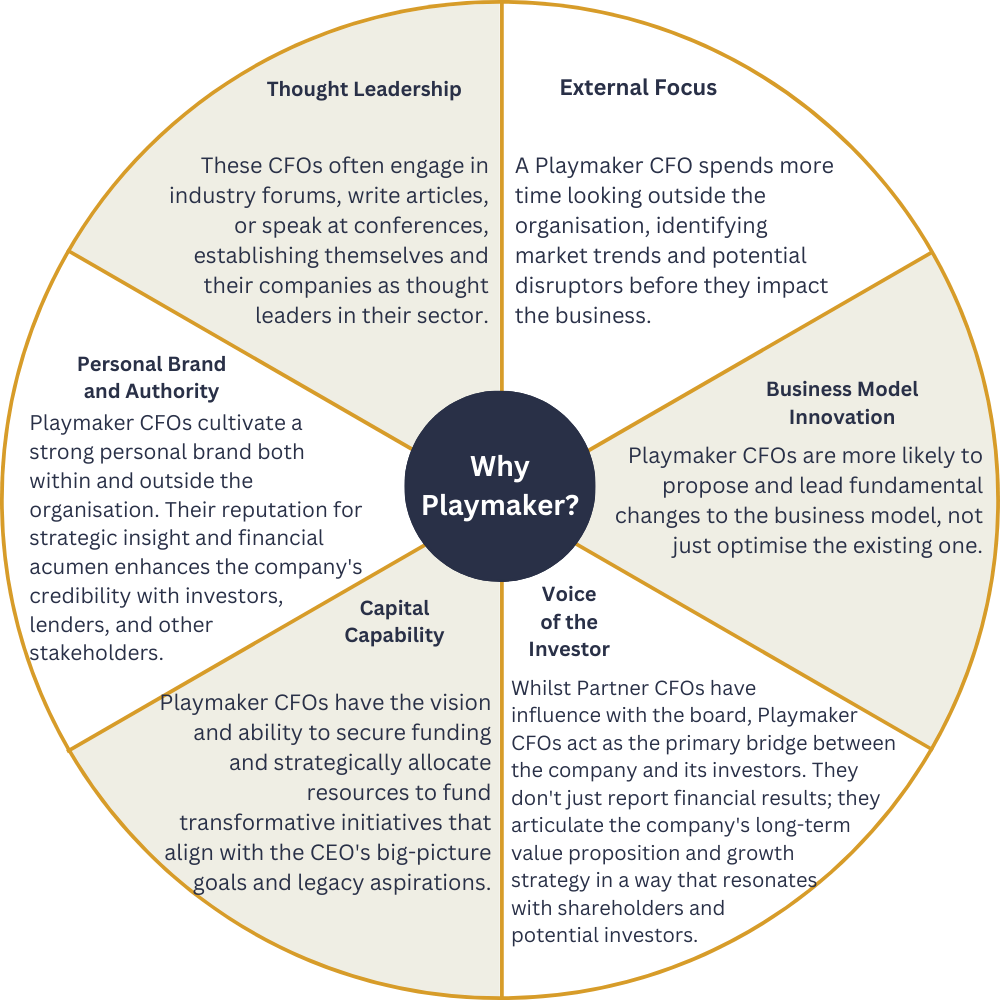

Playmaker CFOs build upon the strengths of the Partner. The transition from Partner to Playmaker is marked by a shift from strategic guide to visionary leader.

Here's how a Playmaker CFO differs from a Partner CFO in their behaviour and impact:

Playmaker CFOs represent less than 4% of all CFOs. Reaching the Playmaker level is a significant achievement, representing the pinnacle of CFO evolution.

Are you a Partner CFO?

Is your CEO supporting your growth?

What impact would shifting from Partner to Playmaker have on you and your organisation?

I'd love to hear your thoughts...