11/15/2024 15:30:00 +0800

• Learn why top CFOs are shifting to refined control to drive sustainable growth.

• Discover the long-term benefits of positioning risk management as a business value-add.

• Understand how disciplined decision-making can prepare businesses to survive the economic downswings and capitalise on the upswings.

A question that I'm being asked more and more frequently is "what can you do to grow during an economic downturn?"

At our most recent quarterly meeting, held at the beautiful Cruising Yacht Club of Australia in Darling Point, Sydney, I turned this question on my CFO Boardroom members.

"Maturity", "Discipline" and "Accountability" were words that came up again and again, however one answer given by a veteran Boardroom member perfectly articulated their sentiments; "Refined Control".

He went on to add "mature growth means that you're not just piling on new products or services whenever times are good and then slashing costs when times are bad; it means taking the time to reinforce the foundations; strengthening the core of the business and prioritising the quality of financial decisions when business is slow so you can set the business up for long-term success when the economy rebounds".

If you're wondering what skills world-class CFOs should be building in uncertain economic times, "refined control" is it.

Refined control goes beyond simply "keeping things steady." It's a disciplined, proactive approach that ensures every decision reinforces the business's existing strengths. Here's what refined control entails:

• Strengthen Core Processes: Strong, well-defined processes provide a stable base for future growth. World-class CFOs understand that focusing on foundational elements of the business yields more sustainable results over the long term.

• Ensure Measurable Value: Each investment is scrutinised for its ability to drive clear outcomes. CFOs practising refined control demand that every dollar delivers a return above set benchmarks.

• Demand Real Returns: For example, a recent client of mine secured a 5.5% return on a cash deposit. If a bank account can yield this, every other investment should meet or exceed this baseline.

Why Cost-Cutting Alone Isn't The Answer

When the economy gets tough, there's a strong temptation to slash costs as a quick fix. But for world-class CFOs, simply cutting expenses indiscriminately is a lazy approach that often does more harm than good.

Cost-cutting might offer immediate savings, but it often sacrifices long-term growth and morale. CFOs leading with refined control see beyond the numbers and focus on making strategic adjustments that add value without stifling the business's potential.

The Role of Risk Management

Risk management is central to refined control. Traditionally, the risk management function was seen as a way to avoid disaster and many business leaders saw it as a hindrance to success, but future-ready CFOs now approach it as a value-adding function.

Proper risk management allows CFOs to safeguard the business while still seeking opportunities for strategic growth. Here's how:

• Identify Strategic Risks: Effective risk management goes beyond compliance to identify which risks can be leveraged for competitive advantage.

• Balance Risk and Reward: Rather than avoiding risk altogether, today's CFOs use risk management processes to make informed choices that add long-term value to the business.

• Embed Risk into Decisions: Refined control means embedding risk considerations into every investment and strategic initiative, ensuring the business remains stable and flexible.

When risk is approached as a strategic value add, it can improve the quality of decision making, increase business agility and enhance stakeholder trust.

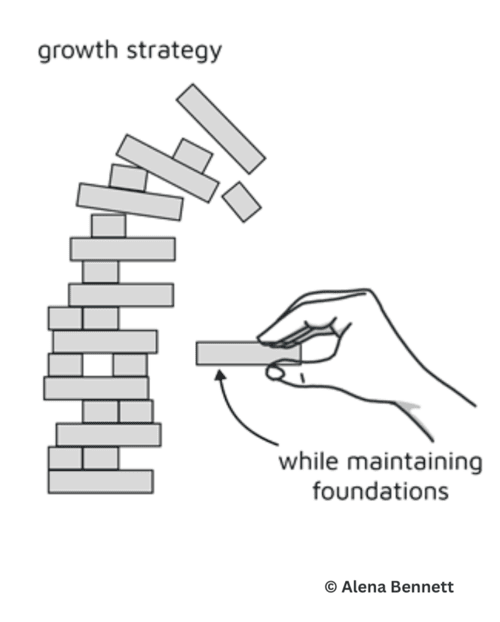

magine the game of Jenga: each block you add must be carefully chosen to keep the tower stable. Only when the tower is built on solid foundations can it reach its full potential.

World-class CFOs approach growth with this same sense of discipline, strengthening foundational processes and exercising good financial stewardship to support sustainable growth - ensuring the business stands firm when new building blocks are added.

Building Leadership Maturity

This approach requires more than just financial savvy; it demands leadership maturity. By maintaining focus on outcomes and consistently measuring ROI, world-class CFOs demonstrate the discipline and vision that separates them from reactive financial managers.

This fosters a culture where:

• Processes and controls are strengthened: Strong controls provide the structure needed for smart, agile decision-making.

• Accountability is elevated across the organisation: CFOs who lead with refined control set a standard of accountability that resonates throughout the organisation, creating a culture where every team member understands the importance of disciplined growth.

With refined control, CFOs are playing the long game. By reinforcing the organisation's foundation and making decisions that build sustainable value, CFOs are preparing their businesses to thrive when economic conditions improve.

Key Takeaways for CFOs Seeking Long-Term Success:

• Prioritise Refined Control: Move from reactive cost-cutting to disciplined, ROI-focused investments.

• Integrate Risk Management: Use risk management as a strategic tool that contributes to resilience and growth.

• Model Leadership Maturity: Set standards for accountability and strategic decision-making.

By approaching risk management as a value add, today's CFOs are embedding resilience into the organisation's DNA, ensuring that every financial decision contributes to sustainable long-term growth.

How could demonstrating refined control add value to your business?

I'd love to hear your thoughts...

If your CFO is ready to step up and lead with greater maturity, it's time to sign them up to the CFO boardroom before prices rise in 2025.

The CFO Boardroom is my signature program. In it, CFOs join a confidential community of other CFO's ready to play bigger, increase their impact and elevate the office of the CFO in the next 12 months. Our December intake is now open.