Recently, I've noticed a shift in how she is playing. She's no longer simply reacting to her opponents moves or following a set playbook. Instead, she's starting to anticipate the moves of her opponent and thinking several moves into the future. This transition reminded me of the evolution from a Deliverer CFO to an Adviser CFO.

Adviser CFOs are like advanced chess players. They've mastered the fundamentals and are now applying their skills to influence the broader game - or in this case, the entire business strategy.

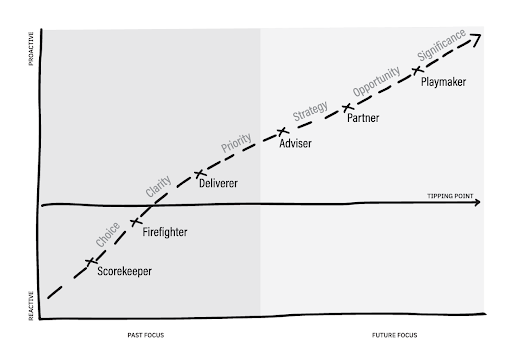

In our CFO Evolution blog series, we've explored the reactive Firefighter and the capable Deliverer. Now, let's chat about the Adviser CFO - a CFO who is turning data into insights and ready to turn insights into influence.

According to our research, Adviser CFOs make up about 45.85% of all CFOs. This is the level where many finance leaders find their stride, balancing operational expertise with strategic insight.

1. They're in high demand, frequently asked to "have a minute to talk" or "bounce ideas off"

2. They're very active in meetings and on calls, fielding questions and sharing knowledge

3. They have extensive contact with important people in the organisation, but primarily through other executives rather than directly with the CEO

4. They provide valuable advice, but it's not always acted upon

5. They're comfortable in their advisory role, which can sometimes hold them back from taking on more strategic responsibilities

Does this sound like you? If so, you're a financial leader who's valued for their knowledge and insights but may not yet be fully leveraging your potential strategic impact.

• Adviser CFOs may struggle to fully let go of operational details. They know the importance of strategy, but the pull of day-to-day operations can still be strong.

• While Adviser CFOs have a seat at the strategic table, they may still be working on fully leveraging their influence across all areas of the business.

• As their role expands, Adviser CFOs need to balance the sometimes conflicting expectations of the board, the CEO, their peers, and their team. As the CEO, you'll find that you still need to provide a fair degree of direction in this area.

Remember, these challenges are growth opportunities in disguise. Each one overcome is a step towards becoming an even more effective strategic partner.

As your strengths are fully leveraged, you can expect to see:

1. Improved Strategic Foresight: Your financial insight will evolve into proactive strategic planning.

2. Increased Influence: You'll move beyond delivering internal advice to shaping both internal and external stakeholder perspectives.

3. Genuine Partnership: An engaged Advisor CFO will transition from a trusted advisor to a key strategic partner in decision-making.

Partner CFOs build upon the strengths of the Adviser, taking on an even more integral role in shaping the organisation's future. They're not just contributing to strategic discussions; they're co-creating the vision alongside the CEO.

The transition from Adviser to Partner is marked by:

1. A shift from providing insights to driving key business decisions

2. Increased focus on external stakeholder management, including investors and board members

3. A broader perspective that extends beyond finance to all aspects of the business

4. Enhanced ability to lead change across the entire organisation

While the Partner role represents significant growth, it's not the final stage. The ultimate goal is to reach the Playmaker level, which we'll explore in our next blog in the CFO Evolution series.

Are you - like many of your peers - an Adviser CFO?

Where is the opportunity to grow into Partner?

What support do you need from your CEO?

I'd love to hear your thoughts...