One of the most valuable parts of being part of a CFO community is the ability to hear and learn from others' experiences and challenges.

What's quickly evident is that while the challenges are plentiful and infinite, there are common themes and it is in the relationship between some of these themes that is commonly where the real gold lies.

INTERNAL FACTORS...'the job'

I think the CFO does 3 primary activities:

1. Think

2. Influence

3. Do (otherwise known as implement, execute, deliver)

CFOs are exceptional thinkers

What makes a CFO stand out is their ability to aggregate and synthesise the decades of experience, formal and informal learning into practical and innovative solutions to business problems.

However, for some CFOS the thinking comes naturally. They revel in the time alone to ponder over ideas, issues and solutions. Give them a problem and they will do everything in their power to solve for it. They're a real asset to have in your organisation.

On the other hand, 'Thinker' CFOs are prone to perfectionism, procrastination and often receive feedback from the business that they're solutions aren't practical (or simply aren't invited back to the next meeting).

CFOs are in the business of selling...ideas

CFOs spend much of their time in high stakes conversations. While I frequently hear 'I'm not that good at selling myself', what many CFOs don't realise is that they're in the business of selling! CFOs are always selling ideas – they just call it influence.

Whether it's the latest policy or process change as a result of the new IT system, the adjustments to the departmental budget or getting complex accounting issues across to the Board, much of a CFOs energy is spent determining the most effective and efficient way to sell their latest idea.

There are some 'Sales' CFOs out there. They're typically the ones that are highly commercial – either have a background in sales, investment banking or in a Private Equity-backed organisation. These CFOs are exceptional at the Executive Table and Board – in fact, they are the epitome of gravitas.

Sometimes 'Sales' CFOs 'write cheques their team can't cash' or in trying to deliver on the Sales CFO promise, creates burnout or causes collateral damage in the process.

Doer CFOs get the job done

So many CFOs are their CEO's safe pair of hands. As I phrase it in CFO of the future, 'the voice of reason next to their CEO's voice of vision'. As I mentioned in my article last week, there is a reason ESG responsibilities are quite often falling into the remit of the CFO.

The downside of a 'doer' CFO is their propensity to 'do' at the expense of their own development, profile or leadership opportunity. If they get distracted with their head down in the weeds, the strategic conversation literally goes over their heads and there is limited opportunity to get involved.

Thinker, Influencer, Doer...in which order is your natural preference?

EXTERNAL FACTORS...'the job' and more!

Again, for the purposes of simplicity, I see 3 key external challenges that CFOs face on a regular basis. These are:

• The job

• The environment

• The people

The job

The role of a CFO has evolved and changed significantly over the past few decades. So much so that to compare 2 different CFO roles and job descriptions is often like comparing apples and pears – they bear some semblance to each other, but are actually quite different beasts.

Depending on the job specifications of the role, the skills required also differ and as a result, in order to stay relevant and achieve job fulfilment upskilling is pat of the job. But the upskilling is on both the technical and non-technical sides – it can feel like a full time job!

The environment

I see CFOs go from organisation to organisation and the difference in their experience and quality and quantity of output tells me that environment matters. It's why we talk about the difference (and frustration) that exists between performance and potential – because you might 'know' you have the ability to be a business partner or playmaker but the context means that you're constantly fighting fires all day every day.

The people

You might have heard me make the following assertion 'Chief Financial Officer is a people job. Most people think it's a numbers job, but it's actually about the people. It's stuff that people do and people create that forms the basis of the numbers. What happens with those numbers (allocation of scarce resources) is determined through the decisions of people.'

So I think 'people' are the most important and relevant input into the performance equation for CFOs. 'People' might relate to:

• Performance issues

• Talent shortages

• Difficult stakeholders

Or any other 'people' related matter. The presence of people greatly influences how easy or hard your job is as a CFO.

The job, the environment, the people...what element most impacts your performance?

I think the hardest part of being a CFO is that these influences on our performance don't happen in isolation. They never do. What makes the role of a CFO challenging is the combination of factors.

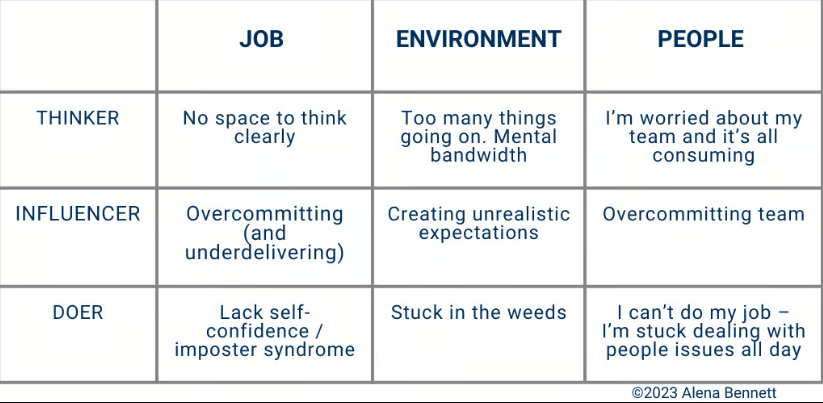

So here is a shortcut to help you figure out what's really going on if depending on whether you're a thinker, influencer or doer CFO by nature.

INTEGRATING INTERNAL AND EXTERNAL

What's really going on?

When CFOs book a clarity call with me, by answering 3 simple questions they tell me they've got:

1. clarity with what is going on

2. the (real) problem they have

3. confidence to take a practical step forward

What this tells me is that there is deep value in cutting through all the challenges and identifying the one that really matters.

My hope is that by reading this you now have a greater understanding of your context so you, too, have the confidence to take the next step.